Create Your Jewish Legacy

Jewish tradition teaches that one of our key duties is to make the world a better place for future generations. Chances are you already donate to the Jewish charitable organizations of your choice. But have you considered including those organizations in your will so that you can continue to make a difference for generations to come? Whether you use a will or other estate planning vehicle, your generosity can do a world of good. The Jewish Endowment Foundation of Louisiana and an estate planning professional can help you start this rewarding process. The legacy planning process can engender heartfelt conversations with your family and build bonds with your partners in the community. When you create your Jewish legacy you reflect what is most important and meaningful to you and help to ensure our community’s Jewish future will be bright.

Debbie Berins, Assistant Executive Director

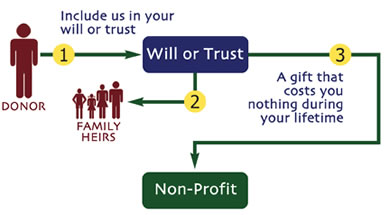

The most common form of deferred giving, an outright charitable bequest, is made through terms of a will. It may be either a specified amount, a percentage of a final estate, or the residual of an estate after all other specific bequests have been made. A simple codicil added to your will can establish a bequest to one or more of your favorite charitable organizations. We recommend consulting your attorney or accountant to make additions or changes to your will and to assure that it meets state requirements.

The most common form of deferred giving, an outright charitable bequest, is made through terms of a will. It may be either a specified amount, a percentage of a final estate, or the residual of an estate after all other specific bequests have been made. A simple codicil added to your will can establish a bequest to one or more of your favorite charitable organizations. We recommend consulting your attorney or accountant to make additions or changes to your will and to assure that it meets state requirements.

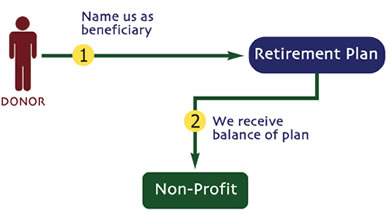

Any funds remaining in an Individual Retirement Account (IRA) or other type of retirement plan may be taxed substantially after your death and/or that of your spouse. Taxes due on your retirement plan may be avoided by naming a charity as the beneficiary of your plan. The company holding your plan can provide you with a Beneficiary Designation Form. Other assets can be left to your heirs, and your Jewish community can receive a significant contribution in your name from your retirement account.

Any funds remaining in an Individual Retirement Account (IRA) or other type of retirement plan may be taxed substantially after your death and/or that of your spouse. Taxes due on your retirement plan may be avoided by naming a charity as the beneficiary of your plan. The company holding your plan can provide you with a Beneficiary Designation Form. Other assets can be left to your heirs, and your Jewish community can receive a significant contribution in your name from your retirement account.

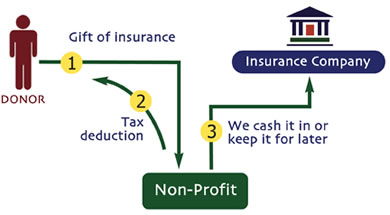

You can donate a new or previously existing life insurance policy to the Jewish Endowment Foundation. Life insurance policy donations can increase income tax deductions while decreasing your taxable estate. You receive an income tax deduction at the time of your gift. If you continue to pay premiums on that policy, each payment constitutes a charitable contribution at that time. You can designate the organizations you would like to benefit from this donation after your lifetime.

You can donate a new or previously existing life insurance policy to the Jewish Endowment Foundation. Life insurance policy donations can increase income tax deductions while decreasing your taxable estate. You receive an income tax deduction at the time of your gift. If you continue to pay premiums on that policy, each payment constitutes a charitable contribution at that time. You can designate the organizations you would like to benefit from this donation after your lifetime.

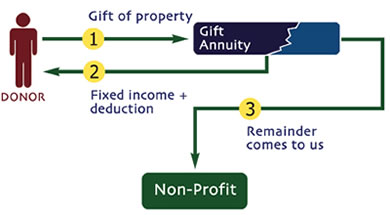

In exchange for a gift to a charity, the charity provides a specific income for life for up to two individuals, which may include the donor. The annuity amount or rate is based on the age of the donor. There are immediate tax benefits from this gift, and with interest rates at all-time lows, this is a charitable way to increase income. At the death of the donor, the remaining funds are available for use by the charity.

In exchange for a gift to a charity, the charity provides a specific income for life for up to two individuals, which may include the donor. The annuity amount or rate is based on the age of the donor. There are immediate tax benefits from this gift, and with interest rates at all-time lows, this is a charitable way to increase income. At the death of the donor, the remaining funds are available for use by the charity.

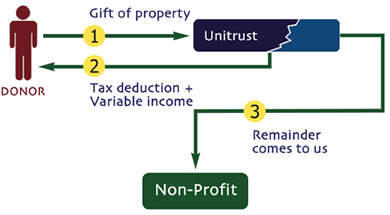

You can establish a fund in your name or that of your family through several types of remainder trusts tailored to meet your estate planning goals and the needs of your beneficiaries. You set aside an asset for a favorite 501©(3) organization while continuing to receive annual income from it during your lifetime. The income may continue for the life of additional beneficiaries, such as your spouse or children. Upon termination of the trust, the remaining principal reverts to the charity or charities that you name.

You can establish a fund in your name or that of your family through several types of remainder trusts tailored to meet your estate planning goals and the needs of your beneficiaries. You set aside an asset for a favorite 501©(3) organization while continuing to receive annual income from it during your lifetime. The income may continue for the life of additional beneficiaries, such as your spouse or children. Upon termination of the trust, the remaining principal reverts to the charity or charities that you name.

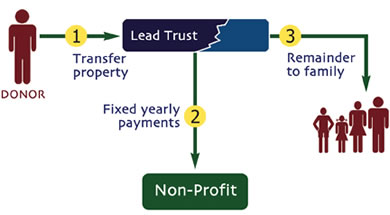

If you do not need the income produced by a certain asset while you are living, you can consider creating a Charitable Lead Trust. The income is paid to the Jewish Endowment Foundation for a fixed or determined period with the remainder either returning to you or passing to a beneficiary.

If you do not need the income produced by a certain asset while you are living, you can consider creating a Charitable Lead Trust. The income is paid to the Jewish Endowment Foundation for a fixed or determined period with the remainder either returning to you or passing to a beneficiary.